InfoTrends is pleased to announce a new study entitled Production Print Services in North America: Understanding Industry Transformation. This study provides insight on the impact of larger Print Service Providers (PSPs) on the overall market in terms of impressions, revenue, and capital expenditures. InfoTrends identifies the attributes of those most likely to make significant investments in hardware, software, and services in relation to their ability to grow revenues.

While many print service providers are developing new services or evolving to a marketing services provider, others are focused on profiting from niche opportunities in print. Regardless of business approach, the industry remains focused on efficiency and higher levels of productivity. InfoTrends examines various industry segments, business models, and the impact of establishment size in both the in-plant and print for pay segments within this study.

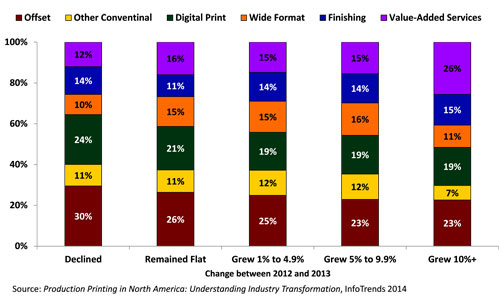

This study examined various industry segments and drivers for success among PSPs. Service providers of all sizes are facing new business challenges and unprecedented complexity, but the winners in the marketplace demonstrated clear differences in the strategies that they deployed. One key driver identified was a focus on value-added services. The high-growth firms clearly understand that today’s market isn’t just about competing for print. These firms are focused on competing across the entire value chain from strategy and creative to fulfillment. Growth companies also understand that the competition is more than just print, and an investment in digital print technology doesn’t necessarily generate stronger business results. The competition is associated with new communication technologies combined with print services.

Study results showed that:

- The print service providers that grew 10 percent or more attributed the highest share of their revenues (26 percent) to value-added services.

- The print service providers with declining revenues attributed the highest value to conventional printing (41 percent, compared to only 30 percent for the companies that grew 10 percent or more between 2012 and 2013).

- The share of revenue from digital print was fairly constant across all growth bands. This suggests that while digital print is important, it must be integrated with additional services.

What percentage of your revenue comes from the following sources?