“Diverse and Developing.” That’s the only way to describe the current breadth of the polymer materials portfolio for additive manufacturing.

From materials that vary in form factor (i.e., powders, resins, filaments) to material properties (i.e., flexible, reinforced, tough, etc.) to application (i.e., medical, industrial, dental, etc.), it can be difficult to define suitable enough categories that adequately cover this diverse market.

This job becomes even tougher when one considers how many more polymers are being added to the AM market every year!

For example, at Formnext 2022 alone, IDTechEx tracked a large number of companies announcing new polymer materials for 3D printing.

Additionally 3D printer manufacturers continue to innovate on printer technologies (i.e., reactive thermoset extrusion, selective thermoplastic electrophotographic process (STEP), etc.), which subsequentially require more tailored polymer materials to suit those technologies.

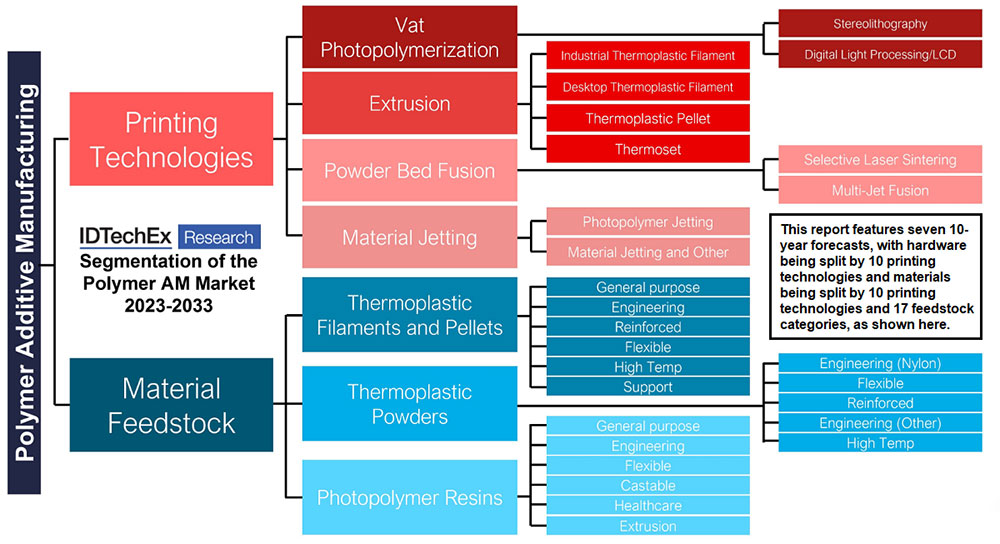

To break down the market in the most comprehensive way, IDTechEx approaches this with a multi-tiered approach.

The first is a high-level segmentation based on the materials’ form factor: thermoplastic powders, thermoplastic filaments, and photopolymer resins. These three overwhelmingly dominate the polymer 3D printing industry.

However each of those form factor categories contains a lot of variation and diversity in materials, each of which will have different growth trends.

For example, PLA (polylactide) filaments, a long-established low-cost material, have a much different market position and trajectory compared to PEEK (polyether ether ketone) filaments, a high-performance, more expensive material.

Thus, it’s quite helpful to segment these three categories even further to examine the trends developing for more specific categories.

IDTechEx has chosen to use a mixture of material property-based categories (i.e., Engineering (Nylon), Flexible, Reinforced, etc.) and application-based categories (i.e., General Purpose, Support, Healthcare, etc.) to define five different segments for thermoplastic powders, six for thermoplastic filaments, and six for photopolymer resins for a total of seventeen different segments of polymer additive manufacturing materials.

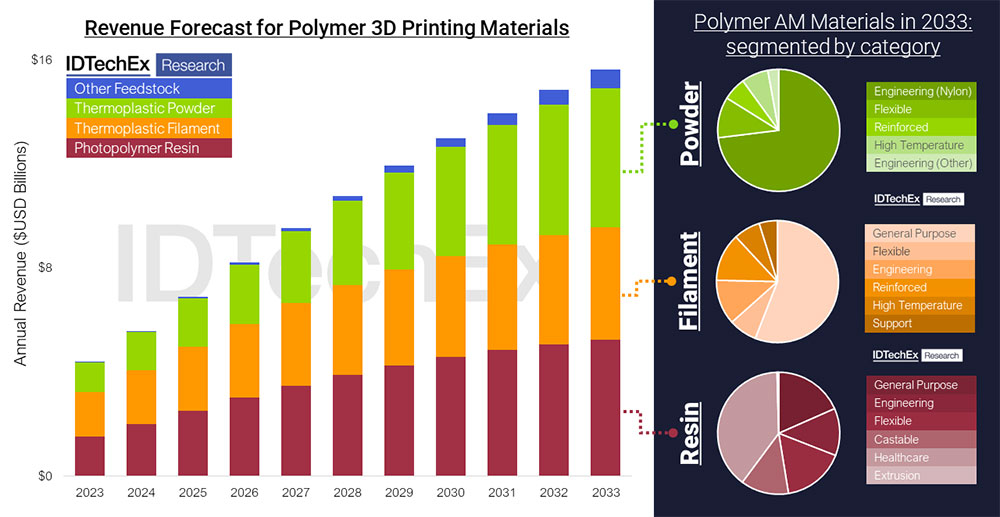

By developing these segments and then forecasting their ten-year outlook, IDTechEx finds that while filaments are the dominant feedstock form by revenue in 2022, they are quickly losing ground to resins and powders, which are used by higher throughput technologies with more expensive feedstock.

The main example of this would be in thermoplastic powders, which benefits from being used by selective laser sintering (SLS) and multi-jet fusion (MJF), two high-throughput printing technologies targeted towards high-volume applications.

Additionally the most common thermoplastic powder material, nylon, starts at around US $100-120 per kilo, far above the starting price for popular thermoplastic filaments like PLA, which start at US $15-20 per kilo. These two factors result in the revenue generated by thermoplastic powder sales surpassing that of thermoplastic filaments and photopolymer resins by 2033.

Drivers Influencing Polymer Material Development for 3D Printing

While these forecasts from IDTechEx break down how polymer AM materials will evolve over the next ten years, they do not comment on the market forces influencing polymer materials development, which are essential to fully understand the polymer AM materials industry.

The two most important factors can be broadly broken down into (A.) the need to reduce materials cost and (B.) the need to increase the available polymer materials portfolio for AM.

First and foremost, materials cost continues to be a pressing concern for AM users; according to a 2021 survey by multinational materials supplier Jabil, 53 percent of respondents reported that a top challenge they face with 3D printing is that AM materials are too expensive to use at scale.

In general, the cost of materials for a 3D-printed part makes up a much higher proportion of the final unit cost than with a traditionally manufactured part.

A University of Nottingham study further exploring the economics of 3D printing found that, for a given SLS part, material costs made up nearly a third of the total unit cost.

While the cost per kilo of AM polymers is expected to decrease as the AM economy scales, given the importance of cost concerns for AM users, AM materials suppliers are still exploring different approaches to reduce the costs inherent in producing AM materials.

One approach involves the reduction of initial feedstock costs to reduce the cost of the final AM material; some look at converting waste or recycled materials into filaments to accomplish this, while Polish start-up AlphaPowders is developing equipment that converts cheaply synthesized thermoplastic powder into AM-grade powder.

Another approach involves the development of lower-cost AM-material production equipment; the DLR Institute of Composite Structures and Adaptive Systems sought to make continuous fiber polymer composite materials cheaper to produce by making lower-cost production equipment.

Yet another approach centers on using additive design techniques, like generative design and lattice structures, to reduce materials consumption compared to traditionally manufactured parts; while this does not change the base cost of the material per kilo, it does help lower the total materials cost per part.

Secondly the lack of necessary materials is another concern for AM users, with the same 2021 Jabil survey finding that one-third of AM user respondents cite as a key challenge that the needed materials are not available for 3D printing. That challenge is also compounded by the fact that the high-performance polymers most desired for end-use applications tend to be the most expensive.

Still 3D printing companies continue to address this challenge with their new materials releases, which often target specific high-performance industries.

For example, multiple companies like Desktop Metal and PrintFoam have developed “true” foam materials for 3D printing, which aim to improve upon the “digital” foam common in 3D printing, which emulates foam not by using actual foaming material but through printing an open-cell lattice structure.

Another example would be the development of dielectric materials for radio-frequency applications by companies like Fortify (in collaboration with Rogers Corporation) and Nanoe.

Other materials coming to market that look to address demanding applications include room-temperature-cure polyurethanes, like those developed by Chromatic 3D Materials and PPG Industries, and viscous photopolymer resins, like those developed by Cubicure, BCN3D (in collaboration with Arkema), and Quantica.

Still much work is needed for the high-performance materials portfolio of 3D printing to come even close to matching that of injection molding or extrusion.

Overall IDTechEx finds that these two concerns play a big role in the development of each of the seventeen polymer AM material segments over the next decade; what will be interesting to watch is which other challenges will rise as a major influencing factor.

IDTechEx’s “Polymer Additive Manufacturing 2023-2033: Technology and Marketing Outlook” report forecasts future revenue, install base, and materials demand for the polymer AM market while carefully segmenting the polymer AM technology and materials market by ten process categories, three material form factors, and seventeen individual material categories.

Additionally IDTechEx thoroughly analyzes twenty established and emerging polymer printing technologies and provides detailed discussion on the polymer AM materials market.

—By Sona Dadhania, Technology Analyst, IDTechEx