There are now 1,020,000 aerial work platforms (AWPs), also known as mobile elevating work platforms (MEWPs), in the worldwide rental fleet. This is up 6 percent from the previous year, mainly driven by growth in Asia and Latin America, reveals new research commissioned by the International Powered Access Federation (IPAF).

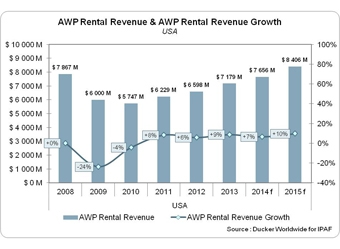

The U.S. AWP rental market rebounded with strong growth of 9 percent in 2013 to reach approximately $7.2 billion, according to the IPAF US Powered Access Rental Market Report 2014. The US AWP rental fleet expanded by 6 percent in 2013. US rental companies used all levers to improve revenue in 2013: expanding fleets and improving rental rates, while enhancing utilization rates.

For the first time, IPAF has conducted research on China, which registered 20 percent growth. The trend is set to continue in this market where there are approximately 6,000 MEWPs, and scissor lifts make up an estimated 65 percent of the fleet.

The European MEWP rental market in the 10 countries surveyed remained stable in 2013 (+0 percent) and is estimated at approximately €2.3 billion, according to the IPAF European Powered Access Rental Market Report 2014. The ten European countries surveyed were: Denmark, Finland, France, Germany, Italy, the Netherlands, Norway, Spain, Sweden and the UK.

The European rental market shows mixed results and is marked by three groups: those who struggled in 2013 (Spain, the Netherlands, Italy, Finland, and to a lesser extent Denmark and France), those who slightly increased rental revenues (Sweden and the UK), and those who experienced significant growth (Germany and Norway).

“The IPAF Rental Market Reports contain a lot of good and extremely useful data that managers in the industry can refer to when formulating their business plans and strategies,” said Mike Disser, Director of Sales, Technology & National Accounts at NES Rentals.

The IPAF rental market reports are presented in an easy-to-read format, highlighting key facts and figures for senior management, such as fleet size, utilization rate and retention period. They include an estimate of the size of the MEWP/AWP rental fleet worldwide, with a breakdown by region and machine type. New for 2014 is an introduction into the rental market in China, which is covered in both reports. The US report includes Canada. The European report includes seven individual country/regional sections: France, Germany, Italy, the Netherlands, Nordic/Scandinavian countries (covering Denmark, Finland, Norway and Sweden), Spain and UK.

The IPAF US and European Powered Access Rental Market Reports 2014 are available in English and can be purchased at www.ipaf.org/reports.